Norwalk Gets First Look At Proposed Budget

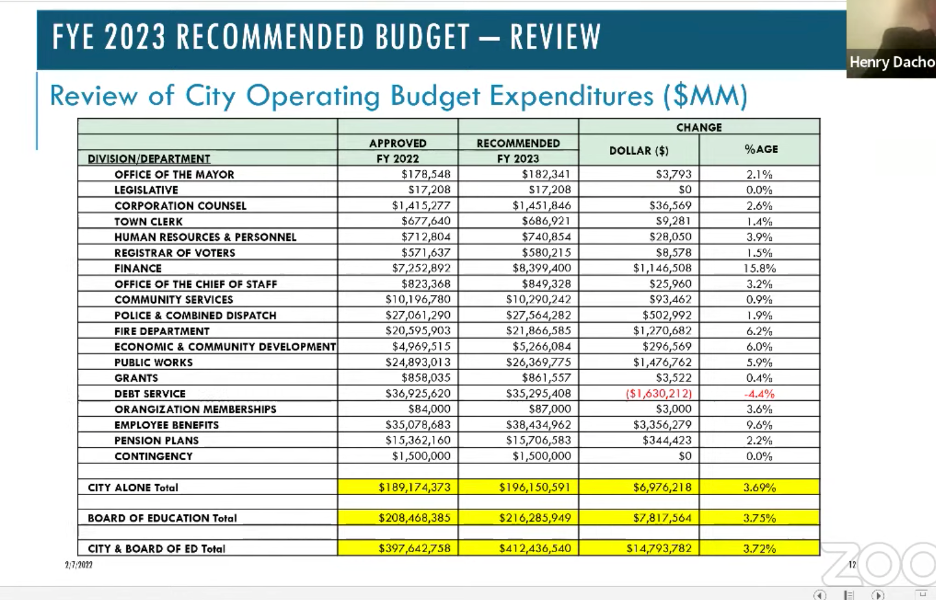

Mayor Harry Rilling and chief financial officer Henry Dachowitz presented their proposed $412.5 million operating budget to the Board of Estimate and Taxation and the Common Council this week.

The proposed budget calls for a 3.75% increase on the school’s side, bringing their budget to $216.3 million and a 3.69% increase on the city side bringing their budget to $196.2 million.

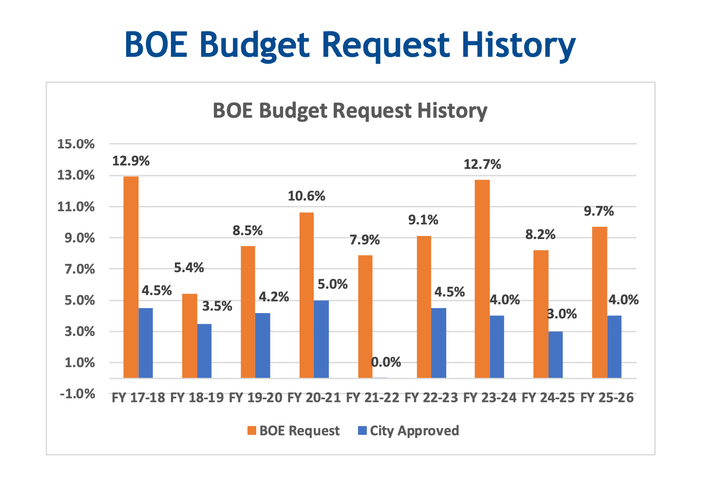

Despite the 3.75% increase on the school side, school officials said that the increase is not enough. The Board of Education approved the superintendent’s budget which asked for a 9.1% increase, bringing it to $227 million for the upcoming year.

As NancyonNorwalk reported, earlier this week Dachowitz told the Common Council’s Finance and Claims Committee that he questioned the “return on investment” the city was getting for funding its schools.

“I think the real question is, we’re spending hundreds of millions of dollars every year in an operating budget. We’re spending hundreds of millions of dollars to upgrade all their schools. But more than half of the children are not doing work at grade level,” Dachowitz said. “So when you talk about what homeowners and taxpayers are willing to pay, I say, the relationship of what the results are in the school should be related to the investment. In finance, we look at return on investment.”

Rilling released a statement on Friday saying that he was “disappointed” in Dachowitz’s comments.

“I want to be clear that I do not agree with Mr. Dachowitz and am disappointed in his remarks. One of my greatest accomplishments as Mayor is the investments we have made in Norwalk Public Schools…Investing in our schools remains a top priority for my administration and I look forward to working with the Board of Education and Common Council to develop the budget for the 2022-23 school year,” his statement read.

This week, the city has called a joint meeting of the Common Council and Board of Education on Tuesday, Feb. 15 at 5:30 p.m. to talk through some of these issues related to the budget.

Meanwhile, the biggest increases on the city side would come from:

- An additional $1.1 million, or 15.8% increase for the Finance Department

- An additional $3.4 million, or 9.6% increase for employee benefits

- An additional $1.2 million, or 6.2% increase for the Fire Department

- An additional $296,569, or 6% increase for the Economic and Community Development office

Dachowitz said that the finance department increase stems from needs in the tax assessor’s office ahead of the 2023 property revaluation and for an additional purchasing manager.

He credited department heads for keeping their increases “very reasonable.”

Rilling said that the budget is “a work in progress.”

“We have a lot more work to do,” he told the Board of Estimate and Taxation. “The last two years have been very difficult.”

Rilling said they have to balance needs, such as providing support for students who have struggled with remote learning and other pandemic challenges, and not over taxing the residents.

“We can’t keep taxing our residents to a point where they can’t stay in their own homes,” he said.

The proposed budget would raise taxes on residents in all six of the city’s taxing districts. The taxing districts vary because some provide different levels of services to their residents. For example, the 2nd Taxing District provides electricity and water, while the 5th Taxing District has its own garbage service.

- The 1st Taxing District would see a 3.2% tax increase, meaning the owner of a median home valued at $240,170 would pay $5,939 in taxes, a $183 increase from last year.

- The 2nd Taxing District would see a 3.2% tax increase, meaning the owner of a median home valued at $227,420 would pay $5,624 in taxes, a $173 increase from last year.

- The 3rd Taxing District would see a 3.2% tax increase, meaning the owner of a median home valued at $308,840 would pay $7,539 in taxes, a $232 increase from last year.

- The 4th Taxing District would see a 3.4% tax increase, meaning the owner of a median home valued at $275,550 would pay $6,855 in taxes, a $227 increase from last year.

- The 5th Taxing District would see a 4.9% tax increase, meaning the owner of a median home valued at $375,840 would pay $9,309 in taxes, a $431 increase from last year.

- The 6th Taxing District would see a 6.8% tax increase, meaning the owner of a median home valued at $764,730 would pay $18,104 in taxes, a $1,153 increase from last year.

Capital Budget

Dachowitz also issued a warning that the city could be in danger of losing its AAA bond rating, which is issued by major credit rating agencies and means that the “creditworthiness is extremely high” and that the municipality has a low risk of defaulting on its loans. Dachowitz said that the city has a large number of approved capital projects that have not yet been bonded in addition to many new school construction expenses.

“My big problem is if we have all those capital expenditures, then the debt service lines grows out of control,” he told the Board of Estimate and Taxation.

If that happens, the city could lose its bond rating, which could leave it subject to higher interest rates on projects.

The city will be continuing to review its capital budget in the coming weeks.