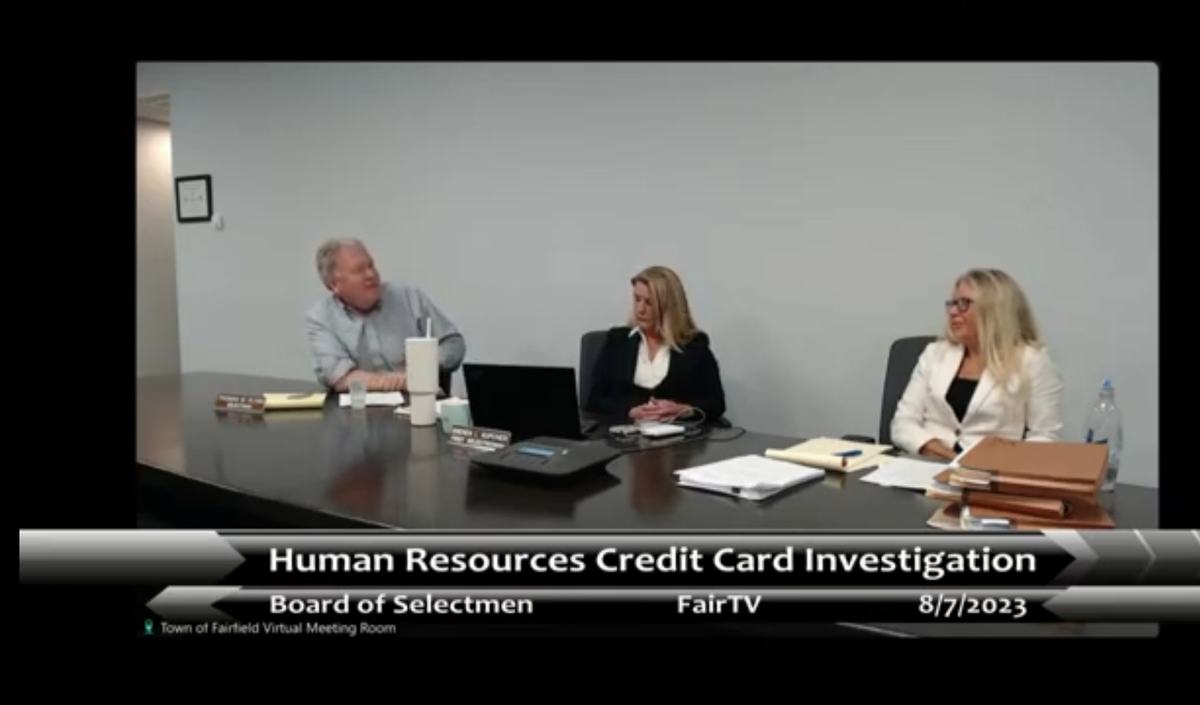

Fairfield Officials Review Credit Card Investigation

Officials in Fairfield reviewed an investigation into how employees were using their town-issued credit cards.

Questions about how Fairfield employees were using their town-issued credit card prompted a six-month investigation into purchases made from 2018 through 2022.

Cathleen Simpson, the town’s HR director, who led the investigation, told the Board of Selectmen at a meeting on August 7 that she found no fraud, but “violations” of the town’s credit card policy.

“We didn’t find any evidence of any defrauding the public,” she said. “If I thought for one second there was any type of fraud, I would have been obligated to refer that to a law enforcement agency if there was rampant fraud.”

Some of the findings included spending money on daily meals for staff, using the town’s Amazon account to make a personal purchase, and buying pain medication like Tylenol on the town card.

Simpson added that there was “corrective action” taken against some employees who violated the policies—which in one of the most severe cases led to restitution and in others led to additional training.

“It wasn’t so aggressive that someone needed to be terminated or arrested,” she said.

First Selectwoman Brenda Kupchick said that she appreciated the investigation and is using it to make additional improvements in town policy.

“There were loose policies in place before I came in, but there was no training so this actually was a good thing because we were able to write more stringent policies and then be in a room with all department heads and explain to all the department heads, this is what the policy is now,” she said.

Still, some officials have concerns that this might be a signal of other issues.

“There are more internal audit reports like this, and if someone is reading these without recognizing what that means and how risky it is, then we have a serious systemic problem,” Board of Finance Chair Lori Charlton said.

As a result of the investigation, the town is implementing or has already implemented a few corrective actions including:

- Adding training related to purchasing and credit card policies

- Splitting up the role of Senior Internal Auditor/Project manager to allow that person to conduct more audits and oversight

- Conducting more regular audits to ensure purchases are properly documented

- Notifying more officials when audits are finished, including the town attorney, human resources, and the First Selectperson

Simpson also said that in addition to splitting the role, they believe there is a current conflict of interest as the current senior internal auditor is also the union president, and recommended addressing that.

“There’s nothing wrong with being in the union if you’re an auditor, that’s fine,” she said. “The problem is that if you’re the union president, you’re also responsible for advocating and representing employees who maybe, potentially would be disciplined. If you’re investigating the very same people you represent, that poses, in my view, a conflict of interest and it also may make you, maybe subconsciously unable to do an investigation without a bias.”

There will also be additional discussions and meetings around the investigation, including a meeting with the Board of Finance soon.

Background on the Investigation

According to Simpson and Kupchick, two things happened that prompted the investigation. The first was a resident, Dana Kery, filed a Freedom of Information Act request related to expenses made on town credit cards. Simpson said that Kery had concerns about some spending and met with her to show her what she found.

“There were some things that looked quite concerning to me and Joanne [Courtemanche, labor relations specialist for the town] and prompted an immediate investigation,” Simpson said.

Kupchick also noted that she had been asked to approve a very expensive travel request from the head of the Water Pollution Control Facility, which raised red flags, and spurred an investigation into his purchases.

Simpson said that they separated out the investigation into the superintendent of the WPCF because “on its face, it looked so egregious as compared to other credit card holders for that time period that we thought immediate action should be taken based on the seriousness of the allegations and it’s a high level position, he handles lots of money so we made that our priority.”

They found that he had been purchasing food and meals for the workers at the plant, as well as some additional purchases, like expensive dinners for himself that resulted in him being placed on leave and paying $800+ in restitution.

“What we discovered there, there was a culture—and again this is not about people—it’s about systems and there was a long term, from what we learned, system of using the credit card for purchases for food and meals for staff,” Simpson said. “It was things like birthday cakes or Chick-Fil-A almost on a daily basis in addition to a seemingly large amount of money spent when they traveled for dining and things like that.”

There was a separate audit from May 2019 to October 2019 that had some similar recommendations about policy awareness and training, but Simpson noted that not much was done with the audit, as it was not sent on to senior officials, like the First Selectwoman.

Responses to the Investigation

Kupchick said that she was “glad they went through this process.”

“We have put in policies now—we have real credit card use policies and training,” she said. “This has been a great learning experience. I’m glad we went through this process and I’m glad that our employees know what the proper protocols are now.”

She also said that she believed people were using the audit as a “political football.”

“I took over a town that was literally mired in the worst public corruption scandal in Fairfield’s history and I grew up here and so did three generations of my family and so I take exception to a member of this board not being upfront and speaking during a meeting instead of posting things on social media, which seems to be how it works now,” she said. “People attack each other on social media instead of having real conversations.”

Kupchick noted that when she took office in November 2019, she had to “fire the CFO who was subsequently arrested,” as well as “the HR director who was also arrested.”

“I had an interim CFO helping me with my first budget in March of 2020 one month after this [initial] report came out that I was never given a copy of,” she said. “What happened in March of 2020? A global pandemic. So there was a lot going on around here.”

However, Selectwoman Nancy Lefkowitz, said that Kupchick has been in office for almost four years now and can’t continue to blame things on the prior administration.

“This admin has been in office for almost four years now so while we can all appreciate the history and what has been inherited, I find the excuse of having inherited these problems at this point really unfair to the citizens of Fairfield,” she said.

Lefkowitz, who is a Democrat, while Kupchick and fellow Selectman Tom Flynn are Republicans, said that she wanted to use her role to “raise questions, to raise awareness so the public can do their due diligence to understand what’s been going on.”

She criticized the administration for sending the audit to the Board of Selectmen on Friday, ahead of the Monday meeting.

“Receiving 1000 pages of backup material for a meeting on Monday—to receive that material at 4:30 on a Friday is actually quite offensive,” she said. “It’s not the actions of an administration or a group of people who are really interested in informed discussion. To me, it’s a firehose. It’s designed to seemingly—and I’m not going to assign intent—but it seemingly seems to be an approach that is designed to confuse, obfuscate, deflect and overwhelm.”

She and Flynn both asked Simpson to add a summary that outlines exactly what was reviewed as a part of the audit, how she and the team came to their conclusions, any metrics that were used, and the total financial impact to the town of these purchases.

Flynn, who said that he has experience from his work in finance related to these types of audit, also called on making sure the accounting and finance departments play their roles in noticing potential violations.

“I see this all the time—it’s a cultural thing that needs to change,” he said. “There’s several systems of checks and balances. There’s the department heads, there’s also your accounting and finance group. [The purchase] should stop automatically if the justification line isn’t filled out.”

Charlton also called for the “appropriate controls” in the finance department to try and catch these contemporaneously, because it’s hard for someone conducting an investigation to get information about why a purchase was made years later.

She also emphasized that she was concerned this was indicative of a bigger problem.

“We don’t spend that much on credit cards, and if we have bills being paid and money going out the door without anyone doing a review—that raises to me concerns that this is going on throughout our expenses,” she said.

Kupchick said there would be more discussions about this, including the next meeting with the Board of Finance.

“We welcome all of the advice and feedback,” she said. “We have been trying from day 1 to clean up tremendous problems.”